Beef Demand Is Strong and Will Grow in 2019

You have probable heard someone say, "Beef demand must be excellent as prices are sharply higher." This may or may not be true.

Need for beef is a schedule of quantities consumers are willing, and able, to buy over a range of prices. As y'all would expect, consumers buy less when prices rise. They purchase more than when prices fall. Importantly, need is the entire set of those toll and quantity pairs.

A line formed by those pairs slopes downwards in a chart with price on the vertical axis and quantity on the horizontal centrality. A lower cost will pair up with higher quantity on that line of cost-quantity pairs, and vice versa. Moving from a higher price-lower quantity pair on that line to a lower price-higher quantity pair on that line is a quantity response driven solely by the change in toll. That is a change in quantity demanded, information technology is not a alter in demand.

Economists employ a formula to predict how much quantity demanded is expected to modify as price changes. It is called price elasticity of demand.

Demand drivers

Factors other than cost bulldoze changes in need. Some are consumer income levels, prices of substitutes and complements, and consumer tastes and preferences.

From Apr-June 2020, supply chain constraints trimmed beef availability and per-capita consumption fell 8.2% compared to the second quarter of 2019. Assuming the cost elasticity for beef is constant over time, retail beef prices should have risen xi.2%. Prices actually surged 17.one%. The greater than expected rise in price says demand increased. Rather than merely sliding to a lower quantity-college price betoken on the demand curve, we had a new cost-quantity pair on a new demand curve farther to the right on the chart.

Sometimes signals are clear

Normally when quantity rises, the toll falls. Sometimes quantity rises and cost also rises. Quantity is responding to more than than the change in toll; demand is rising. In 2020, per-capita beef consumption rose 0.4% from 2019 and real (inflation-adjusted) beef prices spiked eight.4%. During the final 30 years, college prices too came with college quantities in 1999, 2000, 2004, 2012 and 2019.

Sometimes lower prices occur with lower quantities. That says beefiness need is falling. Per-capita beef consumption fell and real beef prices slipped in 1991, 1992, 1993, 1997, 2005 and 2009.

Unfortunately, the market place only provides one price-quantity pair at whatsoever ane betoken in time. That complicates attempting to figure out whether a change in quantity is merely a shift up or down an existing demand curve due to a alter in price (a change in quantity demanded), or a move to a new need curve (a change in demand).

A need index helps measure out shifts to a new demand curve. Forming a demand index requires data on domestic production, imports, exports, and cold storage to derive a disappearance measure. This is and then converted to a per-capita basis by dividing past the Usa population. Per- capita disappearance is an approximation for observed consumption. In reality it measures per-capita supply or availability. Beef is perishable. Each year the corporeality of beefiness we consume roughly equals the amount of beef we produce. Information technology is price that does the adjusting.

We can construct a demand index that can tell us the status of domestic consumer-level beef demand where the index represents all demand, not just demand at retail outlets. This approach uses total consumption and treats the retail price every bit a shadow value for the product sold through food service outlets. A demand alphabetize functions much like a barometer. Evaluation should focus on direction and relative size of alter and not absolute values.

Understand volume signals

You may also hear someone say, "Beef demand must exist stiff as a large quantity is clearing the market." Again, this may be true or false. At what toll is the large quantity existence sold? If prices are lower, so demand may be unchanged. If more is being bought at the prevailing toll, so need could in fact be stronger. But if less beef is immigration the market than the price elasticity of demand would betoken demand may actually be lower.

April-June 2021 saw beef demand rise. Per-capita consumption surged by nine.6% compared to the second quarter of 2020 when COVID-19 related challenges constrained the ability to transform cattle into beefiness. An well-nigh 10% ascension in consumption should accept trimmed real retail beef prices by 10.7%, but prices actually merely slipped 6.1%. The smaller than expected price reject says demand improved.

Piddling consumer resistance even so

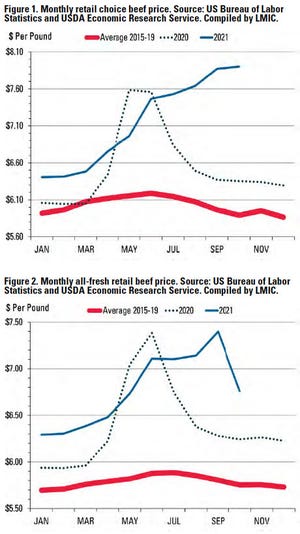

Tape-loftier retail beef prices have fatigued much attention. Figure 1 shows the retail Choice beefiness price and Figure 2 shows the retail all-fresh beefiness price, both published past USDA's Economic Inquiry Service. The retail Choice beef price is a weighted average of prices of Choice beef cuts and ground beef published by the US Bureau of Labor Statistics. The all fresh beefiness price series, includes prices for not-Choice cuts and additional footing beef.

Should we wait consumer pushback against high prices? And even if they do, would this trim producer income? Maybe, but maybe not. Both prices and quantities need to be considered considering then and only and then can you speak to the total dollars available for the industry.

July-September 2021 saw 6.0% lower per-capita beef consumption than during the same three months in 2020 and inflation-adjusted retail beef prices rose 5.9%. Price elasticity of demand indicates prices should have risen a scrap more, say roughly 9.1%. That means the beefiness demand index did fall compared to the third quarter of 2020. Still, the beef demand alphabetize is amid the peak quarters in the information series that dates dorsum to 1990.

Persistent loftier retail prices appear to signal strong consumer-level beef demand. Far from wrecking demand. Loftier prices are show consumers are "willing, and able, to purchase" a relatively high quantity of beef.

Demand is certainly something to lookout going forward, equally some of the variables are expected to move over a broad range. For example, per-capita beef consumption is expected to trend lower over the next few years. It could skid from 2020's 58.4 pounds to 55.0 pounds in 2023.

Impacts catamenia to beef producers

During the depths of the Not bad Recession, beefiness demand eroded and bottomed-out in 2010 (Figure 3). Since then, beef demand has been generally ascension with some bumps forth the mode. The economic effect on producers is clear. If consumer demand was still at 2010'southward level, retail beef prices and hence cattle prices would exist much lower than they are today. Every bit consumer demand varies, the impacts menstruation downwards through the marketing concatenation to producers through derived demand.

Understanding shifts in derived need within the supply chain at specific points in time is circuitous. For instance, even when consumers are willing to pay more than for beef, the retailer buying wholesale beefiness may not be. Likewise, the packer may not be willing to pay more than for fed cattle. The master reason is costs.

Derived demand for wholesale beefiness by retailers reflects the prices they are willing, and able, to pay for a given quantity of beef at the wholesale level. In a competitive market, the departure between the retail beef toll and the wholesale beef price is the cost of getting wholesale beef to the retail meat example. Suppose those costs rising. Derived need for wholesale beef by retailers declines, which equates to a lower wholesale cost for the same quantity of beefiness supplied. Consumers aren't changing their retail demand; but wholesale need is changing.

Similarly, suppose packers' costs ascension significantly. Further suppose retail demand and wholesale demand concur steady. Packer demand volition shift down and prices for fed cattle will reject.

Lee Schulz is an extension livestock specialist for Iowa State University

Source: https://www.wisfarmer.com/story/news/2021/12/07/how-long-strong-beef-demand-continue/6420875001/

0 Response to "Beef Demand Is Strong and Will Grow in 2019"

Postar um comentário